Cashpoint App

What is the Cashpoint App?

The Cashpoint App is a cutting-edge mobile application that revolutionizes the way you manage your finances. It is designed to provide users with a convenient and secure platform for various banking activities, right at their fingertips. With the Cashpoint App, you can easily perform tasks such as money transfers, bill payments, and expense tracking, all from the comfort of your smartphone.How does it work?

The Cashpoint App works by utilizing the latest technology to connect with your bank account or credit card. Once you download and install the app on your mobile device, you can sign up and create an account. During the sign-up process, you will be required to provide some personal information to verify your identity. After creating an account, you can link your bank account or credit card to the app. This allows you to seamlessly transfer funds between your accounts, make bill payments, and track your expenses. The Cashpoint App uses a secure connection to ensure that your financial information remains confidential and protected.Benefits of using the Cashpoint App

1. Convenience: With the Cashpoint App, you can perform various banking tasks anytime and anywhere. Gone are the days of visiting a physical bank branch or waiting in long queues. The app allows you to manage your finances with just a few taps on your smartphone. 2. Speed and Efficiency: The Cashpoint App enables instant money transfers, eliminating the need for traditional bank transfers that can take several business days to process. Whether you need to send money to a friend or pay a bill urgently, the app ensures that your transactions are completed swiftly and efficiently. 3. Expense Tracking: Keeping track of your expenses is crucial for maintaining a healthy financial lifestyle. The Cashpoint App provides a user-friendly interface that allows you to monitor your spending habits and categorize your expenses. This feature helps you gain insights into your financial behavior and make informed decisions about your budget. 4. Rewards and Cashback: One of the standout features of the Cashpoint App is its rewards and cashback program. By using the app for your transactions, you can earn rewards points or cashback on eligible purchases. These rewards can be redeemed for various benefits, such as discounts on future transactions or exclusive offers from partner merchants. 5. Security: The Cashpoint App prioritizes the security of your financial information. It employs advanced encryption techniques to safeguard your personal and financial data. Additionally, the app implements secure login and authentication measures, along with two-factor authentication, to ensure that only authorized individuals can access your account. In conclusion, the Cashpoint App offers a comprehensive and convenient banking solution for modern-day individuals. With its user-friendly interface, instant money transfers, expense tracking capabilities, rewards program, and robust security features, the app provides a seamless and secure banking experience. Download the Cashpoint App today and take control of your finances with ease.Features of the Cashpoint App

The Cashpoint App offers a range of features that make it a convenient and efficient tool for managing your finances. From its easy and secure sign-up process to its cashback and rewards program, here are the key features that set the Cashpoint App apart:

Easy and Secure Sign-up Process

The Cashpoint App provides a seamless and hassle-free sign-up process. With just a few simple steps, you can create your account and start using the app in no time. The app ensures the security of your personal information by using encryption techniques and advanced authentication methods.

User-friendly Interface

The Cashpoint App is designed with a user-friendly interface, making it easy for even the least tech-savvy individuals to navigate. The intuitive layout and clear instructions guide users through the various features and options available, ensuring a smooth and enjoyable user experience.

Instant Money Transfers

One of the standout features of the Cashpoint App is its ability to facilitate instant money transfers. Whether you need to send money to a friend or family member, pay a bill, or make a purchase, the app allows you to transfer funds quickly and securely with just a few taps on your mobile device.

Bill Payment Options

The Cashpoint App offers a wide range of bill payment options, allowing you to conveniently settle your bills without the need for cash or checks. From utility bills to credit card payments, you can easily link your accounts and make payments directly through the app, saving you time and effort.

Cashback and Rewards Program

The Cashpoint App rewards its users with a cashback and rewards program. Every time you make a transaction using the app, you have the opportunity to earn cashback or rewards points. These rewards can be redeemed for various perks such as discounts, gift cards, or even cash deposits into your account.

Overall, the Cashpoint App provides a range of features that make it a valuable tool for managing your finances. From its easy and secure sign-up process to its cashback and rewards program, the app offers convenience, security, and incentives for its users.

How to Use the Cashpoint App

Welcome to the guide on how to use the Cashpoint App! In this article, we will walk you through the step-by-step process of downloading, installing, and utilizing the various features of the Cashpoint App. Let's get started!

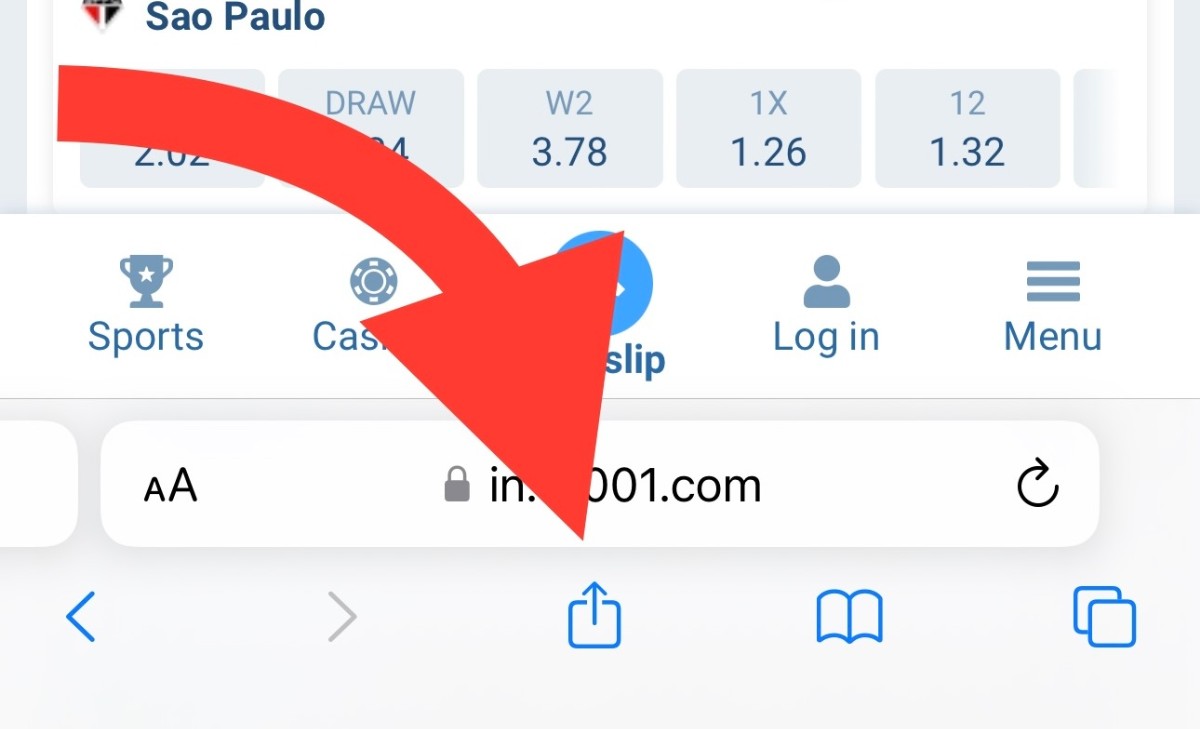

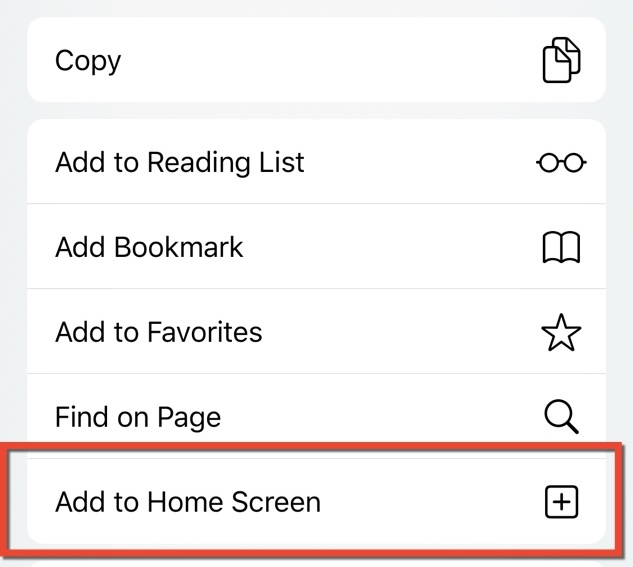

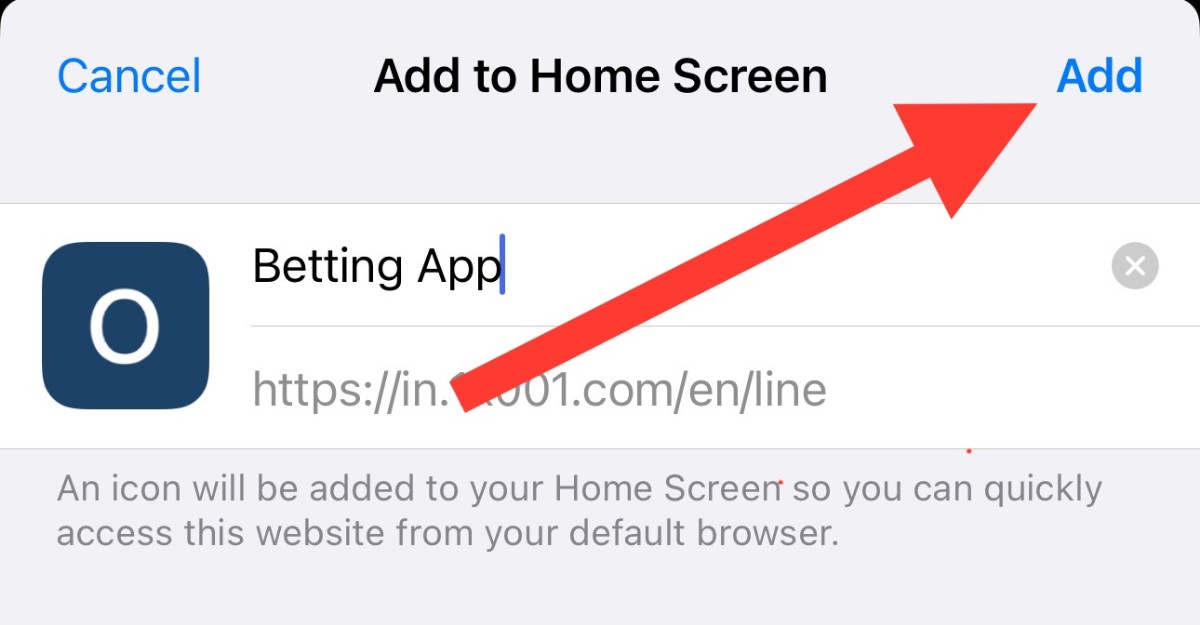

Download and Install the App

The first step is to download the Cashpoint App to your mobile device. You can find the app in the App Store for iOS users and the Google Play Store for Android users. Simply search for "Cashpoint App" and click on the download button to initiate the installation process. Once the app is downloaded, tap on it to open and begin the setup.

Sign Up and Create an Account

Upon opening the Cashpoint App, you will be prompted to sign up and create an account. Provide the necessary information such as your name, email address, and create a secure password. Make sure to read and accept the terms and conditions before proceeding. Once you have filled in all the required details, click on the "Sign Up" button to create your account.

Link Your Bank Account or Credit Card

After successfully creating your account, the next step is to link your bank account or credit card to the Cashpoint App. This will allow you to make seamless transactions and manage your finances directly from the app. To link your bank account or credit card, go to the "Settings" section of the app and select the "Link Account" option. Follow the on-screen instructions to securely link your financial information.

Explore the Different Features and Options

Now that you have set up your account and linked your bank account or credit card, it's time to explore the various features and options available in the Cashpoint App. The app offers a user-friendly interface with intuitive navigation, making it easy for you to access all the functionalities. Some of the key features include:

- Instant money transfers: Send and receive money with just a few taps on your screen.

- Bill payment options: Pay your bills directly from the app, eliminating the need for manual payments.

- Cashback and rewards program: Earn rewards and cashback on your transactions, making your banking experience even more rewarding.

Take your time to familiarize yourself with these features and explore any additional options that may be available within the app. The Cashpoint App aims to provide a comprehensive banking experience, so make the most out of it!

Make Transactions and Manage Your Finances

Now that you are well-versed with the different features of the Cashpoint App, you can start making transactions and managing your finances conveniently from your mobile device. Whether you want to transfer money to a friend, pay your bills, or keep track of your expenses, the app has got you covered.

To make a transaction, simply select the desired option from the main menu of the app. Follow the prompts and enter the necessary details, such as the recipient's information or bill details. Review the transaction before confirming, and once you are satisfied, click on the "Submit" button to complete the transaction.

For managing your finances, the Cashpoint App offers a range of tools and features. You can view your transaction history, set budgets and financial goals, and receive personalized insights into your spending habits. Take advantage of these features to stay on top of your finances and make informed decisions.

Remember to regularly update your Cashpoint App to access the latest features and security enhancements. If you encounter any issues or have any concerns, don't hesitate to reach out to the app's customer support for assistance.

With the Cashpoint App, you can enjoy the convenience of banking at your fingertips. Download the app today and experience a seamless and secure banking experience like never before!

Convenience and Accessibility

The Cashpoint App offers unparalleled convenience and accessibility for users. With just a few taps on your smartphone, you can access your account, perform transactions, and manage your finances anytime, anywhere. Gone are the days of waiting in long queues at the bank or being restricted by traditional banking hours.

Whether you're at home, at work, or on the go, the Cashpoint App allows you to handle your banking needs at your convenience. This level of accessibility ensures that you have full control over your finances, making it easier to keep track of your expenses and make informed financial decisions.

Fast and Secure Transactions

One of the key advantages of using the Cashpoint App is the speed and security it offers for your transactions. With traditional banking methods, transfers and payments can take time to process, causing delays and inconvenience.

However, with the Cashpoint App, you can enjoy instant money transfers between accounts, allowing you to send and receive funds in real-time. This is particularly useful for urgent payments or when you need to split bills with friends or family.

In addition to speed, the Cashpoint App ensures the security of your transactions. It utilizes encryption technology to protect your personal and financial data, keeping it safe from unauthorized access. This provides peace of mind knowing that your sensitive information is secure.

Track and Manage Your Expenses

The Cashpoint App offers robust features that allow you to easily track and manage your expenses. By linking your bank account or credit card to the app, you can view your transaction history, categorize your expenses, and set budgets.

This level of financial visibility helps you stay on top of your spending habits and identify areas where you can save. The app provides detailed reports and visualizations, making it easier to understand your financial health and make informed decisions.

Earn Rewards and Cashback

One of the unique advantages of using the Cashpoint App is the opportunity to earn rewards and cashback. The app offers a loyalty program that rewards you for your transactions and usage.

Every time you make a purchase or transfer funds, you can earn points or cashback, which can be redeemed for various rewards such as discounts, vouchers, or even cash. This incentivizes users to actively engage with the app and maximize their benefits.

Save Time and Effort

Using the Cashpoint App can save you valuable time and effort in managing your finances. With traditional banking methods, you may need to visit multiple branches, fill out paperwork, and wait in long queues to perform simple tasks.

However, with the Cashpoint App, you can avoid these time-consuming processes. You can easily transfer funds, pay bills, and manage your accounts with just a few taps on your smartphone. This not only saves you time but also streamlines your financial management, allowing you to focus on other important aspects of your life.

In conclusion, the Cashpoint App offers a range of advantages that make it a superior choice for your banking needs. Its convenience and accessibility, fast and secure transactions, ability to track and manage expenses, opportunity to earn rewards and cashback, and time-saving features make it a valuable tool in today's fast-paced world. By utilizing the Cashpoint App, you can have full control over your finances and enjoy a seamless banking experience.

Secure login and authentication

The Cashpoint App prioritizes the security of its users by implementing a robust login and authentication process. When you sign up for the app, you will be required to create a strong and unique password. This password is encrypted and stored securely on our servers, ensuring that it is not accessible to anyone, including our own employees.

In addition to a strong password, the Cashpoint App also offers options for biometric authentication, such as fingerprint or facial recognition. This adds an extra layer of security, making it more difficult for unauthorized individuals to access your account.

Encryption of personal and financial data

We understand the importance of protecting your personal and financial information. That's why the Cashpoint App uses industry-standard encryption technology to safeguard your data. When you use the app to make transactions or manage your finances, all the data transmitted between your device and our servers is encrypted.

This encryption ensures that even if someone were to intercept the data, they would not be able to decipher it without the encryption key. This protects your sensitive information, such as bank account details and credit card numbers, from falling into the wrong hands.

Fraud protection measures

The Cashpoint App has implemented various measures to detect and prevent fraudulent activities. Our system uses advanced algorithms to analyze user behavior and identify any suspicious or unauthorized transactions. If any suspicious activity is detected, our team is immediately alerted, and appropriate action is taken to protect your account.

We also have a dedicated fraud prevention team that continuously monitors and analyzes patterns and trends to stay ahead of potential threats. This proactive approach helps us to ensure a secure environment for our users and maintain the integrity of the Cashpoint App.

Two-factor authentication

Two-factor authentication adds an extra layer of security to your Cashpoint App account. With this feature enabled, you will be required to provide a second form of verification in addition to your password when logging in.

This second form of verification can be a unique code sent to your registered mobile number or email address, or it can be generated through an authenticator app. By requiring this additional verification, even if someone manages to obtain your password, they would still need access to your mobile device or email account to log in.

Regular security updates

At Cashpoint, we are committed to staying up-to-date with the latest security practices and technologies. We regularly release updates to our app to address any identified vulnerabilities and strengthen our security measures.

These updates may include bug fixes, performance enhancements, and most importantly, security patches. By keeping your Cashpoint App updated, you ensure that you are benefiting from the latest security enhancements and protecting yourself from potential threats.

Overall, the Cashpoint App takes security seriously and employs a multi-layered approach to ensure the safety of your personal and financial information. With secure login and authentication, encryption of data, fraud protection measures, two-factor authentication, and regular security updates, you can confidently use the Cashpoint App for all your banking needs.

Comparison of features and services

The Cashpoint App offers a range of features and services that set it apart from traditional banking methods. One of the key differences is the ability to access your finances anytime and anywhere, without the need to visit a physical bank branch. With the Cashpoint App, you can perform various banking activities, such as checking your account balance, transferring funds, paying bills, and even applying for loans, all from the convenience of your smartphone. Traditional banking, on the other hand, often requires customers to visit a bank branch during specific working hours, which can be inconvenient and time-consuming. Additionally, traditional banks may have limited services available online or through their mobile apps, making it more difficult to manage your finances efficiently.Convenience and accessibility

When it comes to convenience and accessibility, the Cashpoint App takes the lead. With just a few taps on your smartphone, you can access your account, make transactions, and track your financial activities. This level of convenience is especially beneficial for individuals with busy lifestyles or those who prefer to handle their banking needs on the go. Traditional banking methods often require customers to visit a physical branch and wait in long queues to access services. This can be time-consuming and inconvenient, especially during peak hours. With the Cashpoint App, you can skip the queues and complete your banking tasks with ease.Speed and efficiency

The Cashpoint App offers fast and efficient transactions, allowing users to transfer money instantly to other accounts, pay bills, and even receive payments. With just a few taps, funds can be transferred between accounts within seconds, making it ideal for urgent or time-sensitive transactions. In contrast, traditional banking methods may involve lengthy processes for transactions, such as writing checks or filling out forms. These processes can take time to complete and may require additional steps, such as waiting for a check to clear or for a transaction to be processed.Cost-effectiveness

The Cashpoint App can provide cost savings compared to traditional banking methods. Many traditional banks charge fees for various services, such as ATM withdrawals, paper statements, or even monthly account maintenance fees. These fees can add up over time and impact your overall finances. With the Cashpoint App, many of these fees can be avoided or significantly reduced. For example, you can use the app to check your account balance, transfer funds, and pay bills without incurring any additional charges. This can help you save money in the long run and have better control over your financial expenses.Personalization and customization options

The Cashpoint App offers a high level of personalization and customization options to suit your individual banking needs. You can set up alerts and notifications to keep track of your account activity, create savings goals, and even categorize your expenses for better budgeting. Traditional banking methods may have limited options for personalization, making it difficult to manage your finances according to your specific requirements. The Cashpoint App allows you to tailor your banking experience to match your financial goals and preferences, giving you greater control and flexibility. In conclusion, the Cashpoint App provides numerous advantages over traditional banking methods. Its range of features and services, convenience and accessibility, speed and efficiency, cost-effectiveness, and personalization options make it a superior choice for individuals seeking a modern and efficient banking experience. By embracing the Cashpoint App, users can enjoy the benefits of advanced technology and streamlined financial management, all from the palm of their hand. So why wait? Download the Cashpoint App today and revolutionize the way you bank.Set financial goals and budgets

One of the key advantages of using the Cashpoint App is the ability to set financial goals and budgets. This feature allows you to track your spending and stay on top of your financial goals. Here are some tips to help you make the most out of this feature:

- Start by identifying your financial goals, whether it's saving for a vacation, buying a new car, or paying off debt.

- Set realistic and achievable goals. Break them down into smaller milestones to make them more manageable.

- Use the budgeting tool in the Cashpoint App to allocate your income towards different categories such as groceries, bills, entertainment, and savings.

- Regularly review your budget to ensure you're staying on track. Make adjustments as needed to accommodate any changes in your income or expenses.

- Take advantage of the app's notifications and alerts to keep you informed about your progress and any overspending in specific categories.

Use the app to track your spending

Tracking your spending is an essential step in managing your finances effectively. The Cashpoint App provides a user-friendly interface that allows you to easily track your expenses. Here are some tips to help you get the most out of this feature:

- Link your bank accounts and credit cards to the Cashpoint App to automatically import your transactions.

- Categorize your expenses to get a clear picture of where your money is going. The app may provide some pre-defined categories, but you can also create custom categories that suit your needs.

- Regularly review your transactions to identify any unnecessary or excessive spending. This will help you make informed decisions about where you can cut back and save.

- Set spending limits for specific categories to help you stay within your budget. The app can send you alerts when you're approaching or exceeding your set limits.

- Take advantage of the app's reporting and analysis tools to gain insights into your spending habits. This can help you identify trends and areas where you can make improvements.

Take advantage of rewards and cashback offers

The Cashpoint App offers a rewards and cashback program that allows you to earn additional benefits while using the app. Here are some tips to help you maximize these offers:

- Explore the app's rewards and cashback section to see the available offers. These may include discounts on shopping, dining, travel, or even cashback on specific transactions.

- Keep an eye out for special promotions and limited-time offers. The app may notify you about exclusive deals or partnerships that can help you save money.

- Plan your purchases and transactions around the available rewards and cashback offers. For example, if there's a cashback offer on groceries, consider doing your grocery shopping during that period.

- Regularly check for new offers and updates. The app may introduce new partnerships or rewards programs that can provide additional benefits.

- Make sure to read the terms and conditions of each offer to understand any requirements or limitations. This will ensure you can fully benefit from the rewards and cashback program.

Regularly update your app for the latest features and security enhancements

Keeping your Cashpoint App up to date is crucial to ensure you have access to the latest features and security enhancements. Here are some tips to help you stay on top of updates:

- Enable automatic updates on your device to ensure the Cashpoint App is updated as soon as new versions are released.

- Regularly check the app store for any available updates. Developers often release updates to improve performance, fix bugs, and introduce new features.

- Read the release notes accompanying each update to understand the changes and improvements made to the app.

- Take advantage of new features introduced in updates. These may include enhanced security measures, improved user interface, or additional functionality.

- By keeping your app updated, you can ensure a smooth and secure banking experience while accessing all the latest features and improvements.

Contact customer support for any issues or concerns

If you encounter any issues or have concerns while using the Cashpoint App, don't hesitate to reach out to customer support. Here are some tips for effectively contacting customer support:

- Check the app's help or support section for any relevant FAQs or troubleshooting guides. You may find solutions to common issues without needing to contact customer support.

- If you can't find a solution, look for contact information such as a customer support phone number or email address within the app.

- When contacting customer support, provide clear and detailed information about the issue you're experiencing. Include any error messages, screenshots, or steps to reproduce the problem.

- Be patient and polite when communicating with customer support. They are there to assist you and will likely work towards resolving your issue as quickly as possible.

- If your issue is not resolved or you're not satisfied with the response from customer support, consider escalating the matter to a higher level of support or management.

By following these tips, you can make the most out of the Cashpoint App and ensure a convenient and secure banking experience. Remember to regularly review your financial goals, track your spending, take advantage of rewards, update your app, and reach out to customer support when needed. Download the Cashpoint App today to start enjoying its benefits!

Conclusion

Recap of the benefits and features of the Cashpoint App

The Cashpoint App is a revolutionary mobile banking application that offers a wide range of features and benefits to its users. With a user-friendly interface and a secure sign-up process, the app provides a convenient and efficient way to manage your finances.

One of the key benefits of using the Cashpoint App is the ability to make instant money transfers. Whether you need to send money to a friend or family member or make a payment to a merchant, the app allows you to do so with just a few taps on your smartphone.

In addition to money transfers, the Cashpoint App also offers bill payment options. You can easily pay your utility bills, credit card bills, and other expenses directly from the app, saving you time and effort.

Another great feature of the Cashpoint App is its cashback and rewards program. Every time you make a transaction using the app, you earn cashback or rewards points, which can be redeemed for discounts, gift cards, and other exciting offers.

Overall, the Cashpoint App provides a comprehensive solution for all your banking needs. It offers convenience, security, and a range of features that make managing your finances easier than ever before.

Encouragement to download and use the app for a convenient and secure banking experience

If you haven't already, we highly recommend downloading and using the Cashpoint App for a convenient and secure banking experience. With its user-friendly interface and robust security measures, the app ensures that your financial information is protected at all times.

By using the Cashpoint App, you can save time and effort by easily managing your finances on the go. Whether you need to transfer money, pay bills, or track your expenses, the app provides a seamless and efficient solution.

Furthermore, the cashback and rewards program offered by the Cashpoint App allows you to earn rewards and discounts on your everyday transactions. This means that every time you use the app, you are getting more value for your money.

Don't miss out on the benefits of using the Cashpoint App. Download it today and start enjoying the convenience and security of mobile banking. With regular updates and enhancements, the app continues to evolve to meet the changing needs of its users.

Should you have any questions or concerns, the Cashpoint App's dedicated customer support team is available to assist you. They can provide guidance on using the app, address any issues you may encounter, and ensure that your banking experience is smooth and hassle-free.

In conclusion, the Cashpoint App is a game-changer in the world of mobile banking. Its features, convenience, and security measures make it a top choice for individuals looking for a modern and efficient way to manage their finances. Download the app today and experience the future of banking!